Financial betting looks a lot like traditional trading with one key difference: you never actually take possession of the underlying instrument. In this way, financial betting can be classified as a type of derivative trading. Essentially, all you’re doing is placing a wager on whether or not a stock, bond, index or currency will rise or fall over a given time frame.

If you correctly predict the movement of the instrument, your bet is a winner and you get paid immediately. There are multiple formats of financial trading and we’ll get into those in a second. But first, let’s start with a look where you can bet on financials online today:

Best Financial Betting Sites

Why You May Like Financial Betting

Online financial betting is accessible to anyone as it requires no brokerage account or minimum bankroll. If you have a little cash to spare and an interest in the market, you’re welcome to try your hand with real money “trading.”

Furthermore, financial betting eliminates the expensive fees charged by traditional brokers. Financial betting sites do still take a commission, but the margins are smaller than brokerage commissions.

And finally, the simpler types of financial wagering limit the most you can lose to the size of your initial stake. Other forms such as outright spread betting do involve more risk, but there is no obligation to go there until you’re ready.

Types of Financial Betting Sites

Some forms of financial betting carry greater risks and returns than others. It is very important that you understand the differences so you can choose the format that works best for your risk tolerance. As is the case in all types of wagering, greater potential rewards are associated with greater levels of risk.

Fixed Odds Financial Betting

Fixed odds financial betting is the best starting point for beginners because it is easy to understand and the risk is limited. If you have any familiarity with sports betting, you will feel right at home with fixed odds financials.

Bookmakers set odds on an instrument reaching a predetermined price level within a certain amount of time (5 minutes, 20 minutes, an hour or 24 hours usually). The odds and all potential outcomes are known to you ahead of time. When you select a bet, the bookmaker shows you the potential payout. Therefore, you know how much you might lose (the value of your stake) and how much you stand to win (the payout).

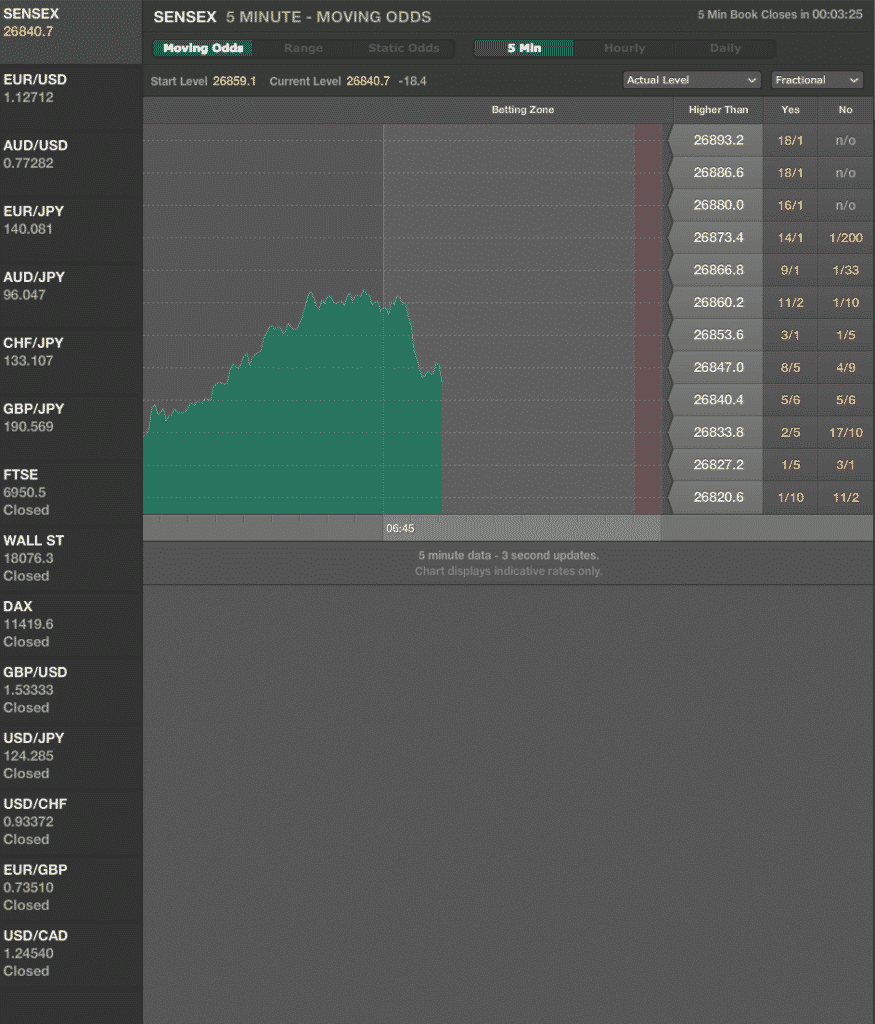

An example of a fixed-odds financial bet would be to bet on the performance of SENSEX (Bombay Stock Exchange Sensitive Index) over the next five minutes.

All those numbers you see on the right side are a collection of possible outcomes that you can take and the betting odds associated with each. The more unlikely the outcome, the more the bet pays. In this example, you can see that a bet on SENSEX breaking 26893.2 within the next five minutes would pay 18-to-1 on your money.

Alternatively, you could place a wager that SENSEX will be above 26820.6 after five minutes. This bet is much lower risk because the market doesn’t have to move as far. The odds reflect this as the bet pays just 1/10 (i.e. you risk £100 for a chance to win £10).

Fixed odds finance wagers can be applied to any instrument in any direction specified by the book. Some sites allow you to bet on instruments moving up, down and staying about level over periods of time. The bookie sets the odds for all outcomes and makes a profit by paying out at slightly lower than the true odds (as estimated by the oddsmaker).

Binary Options Betting Sites

Binary options are the next step up in complexity, reward and risk. In a binary option, you are asked to choose whether an even will or will not happen. In most cases, you end up betting on whether or not an instrument will go up in price, and whether or not it will go down in price.

Prices ranges from 0-100 depending on how likely the binary site thinks the event is to happen. Two prices are given for each instrument; the “buy” price if you think it will increase in value and the “sell” price if you think it will decrease in value.

For example, if you see a stock priced at 72-74, it means you can place a buy bet at 74 or a sell bet at 72. If you’re betting £1 per point, this would cost you either £74 or £72. You would place a buy bet at £74 if you think it will go up and you would place a sell bet at £72 if you think it will go down.

After the specified time period has expired, the binary option closes at either 0 or 100. If you bet that the price would go up, it would close at 100 and you would be paid 100 times your betting denomination. So in this example, you would receive a total of £100 for a net profit of £26 (£100-£74).

The return in binary options is variable, but you still know your total risk and potential reward up front before each bet.

Read more here:

Financial Spread Betting Sites

Online spread betting sits at the top of the risk vs. reward ladder. In financial spread betting, you bet not just on the direction an instrument will move but also on how much it will move. Your potential risk and reward are not known up front because total losses and total profits depend on how far that instrument moves in either direction.

Unlike fixed odds and binary financial bets, spread bets do not expire after a set of time.

You simply purchase the contract to buy or sell at some point in the future. Prices are determined only by how much you’re willing to risk. You select an amount of money to wager per point and then you win or lose that amount for every point the instrument moves in either direction.

For example, let’s say you think the S&P 500 will go up in value. You decide to bet £10 per point. If the S&P 500 moves from 1,881 to 1,891, it has gone up 10 points and your total return is £100 (£10 x 10 points upwards). However, let’s say the market moves against you and the S&P 500 falls by 10 points to 1,871. In this outcome, you would lose £100.

Financial spread betting sites take action on instruments in four major markets: stocks, indices, forex and commodities. Stocks, indices and commodities are all priced according to their current market value while currencies are priced relative to one another. In all cases, your betting site will provide updated buy and sell prices at all times.

The process of actually placing spread bets remains the same no matter which market you choose. The only differences would be in how you conduct research and come to conclusions about future price movements. Stick to what you know for the best results.

Even better, tax laws in some jurisdictions make financial betting cheaper than actually buying and selling shares on the stock market. In the UK, for example, winnings from spread betting are considered to be a result of gambling and are therefore tax-free.

The law may vary where you live, but favourable tax treatment in many countries is partially responsible for spread betting’s surging popularity in recent years.

Going Long vs. Going Short

In traditional trading, going long refers to buying an instrument in the belief that it will grow in value. If you think the Acme Company is well-managed with a bright future, you would go long on the stock and buy it today with the intention of selling it for a profit at some point in the future.

Going long in betting works in the same way, except you don’t actually buy Acme Company stock. You simply place a bet at the buy price.

Likewise, going short is the path taken when you think an instrument will decrease in value. Let’s say you do a little more research and decide you don’t like the looks of Acme Company after all. You suspect bad news is coming soon and decide to go short.

In regular trading, you would borrow X shares of Acme stock from someone today and immediately sell it on the market. You also agree to pay that person for those shares at then-current prices. Hopefully, the share price is lower in the future than what you sold it for today. You can do something similar in spread betting by placing a wager at the current sell price.

What Types of Instruments Can I Bet On?

Financial betting sites tend to focus on four instrument categories: stocks, indices, commodities and currencies. The basic principles of online financial betting apply to all instrument types, but the underlying assets are subject to different market forces. All instruments are equally valid for betting. It’s best to stick with what you know best.

Betting on Stocks

Betting on shares is similar to buying and selling shares over the stock market. The key difference is that you don’t actually purchase shares in the stock and sell them later. Instead, you place wagers on how those shares will perform going forward. If your prediction is correct, you get paid.

Using a spread betting company, you can place bets on the share price of companies listed on different stock exchanges around the world. For an example, let’s assume you wanted to bet on the performance of share in Lloyds – a banking company listed on the London Stock Exchange. At the time of placing your spread bet, the share price is at £1.45 (145p) and your spread betting site offers the spread at 144 – 146.

You want to bet on the price going up, so you place a buy bet at £5 per point at 146. Over the next week, the share price does go up and the spread moves to 154-156. You close your position and get paid out on your bet based on the difference between the price you bought the bet (146) and the price you sold the bet (154). That’s 8 points, so at £5 a point your bet would return a win of £40.00.

Betting on Indices

You can bet on how the world’s major indexes will move in a manner similar to betting on the movements of stocks. For those who don’t know, an index is basically a hypothetical portfolio of securities that represent a larger market or sector. For example, the Standard & Poor’s 500 is probably the best known index in the world. This one tracks the prices and movements of 500 of the largest companies listed on the NYSE or NASDAQ.

Betting on Currencies and Forex

The foreign exchange market (known as the forex market) is the most actively traded financial market in the world. Traders buy and sell currencies with the expectation that any given currency will rise or fall in price relative to some other currency. Currency pairs demonstrate that value of one currency when compared to another. For example, you might want to bet on the price of the USD as it compares to the EUR.

An example spread of the USD/GBP currency pair offered by a spread betting company might be 1.5822 – 1.5825. You might choose to bet on the value of the US dollar increasing against the pound, and as such you would place a buy bet at 1.5825.

If the value of the US dollar actually fell against the pound, then the spread might look something like 1.5788 – 1.5791. If you were concerned that the value might fall even further, then you may choose to close your bet at that point and sell at 1.5788.

In foreign currency spread betting, each .0001 is considered a point. The difference between the price you placed your bet at (1.5825) and the price you closed at (1.5788) is .0037 – 37 points. If you had placed your bet at £2 per point, then you would lose £74.

Betting on Commodities

Commodities are the most basic raw materials mined from the earth and grown in the ground that are ultimately used in manufacturing and commerce. What makes commodities different than other goods is that there is little difference in the product from one producer to another. For example, a sack of grain is basically the same no matter who puts it on the market. Financial betting in this area allows you to predict the future prices of the world’s primary commodities.

Gold is one of the more popular commodities among bettors that spread bet on commodities. An example of a spread offered on the price of gold might be $1735.1 – $1735.6. If you wanted to bet on the price of gold falling, then you would price a sell bet at $1735.1.

If the price of gold actually went up then the spread might become $1736.6 – $1737.1. If you chose to close your bet at that point, and bought at $1737.1 then there would be a $2 difference between the price made your bet at and the price you closed at. Each $.1 is one point, so you would have lost 20 points. At £2 per bet, you would lose £40.

Mike Murphy is the founder of OnlineBettingSites.com and has over 10 years of experience in the legal online betting industry. A regular attendee of industry trade shows and conferences, Mike is a strong proponent of regulated markets and responsible gambling policies.